After the exertion to read the Offer Information Statement (OIS) of Hyflux's preference shares and perpetual capital securities (perps) in the past few weekends, this week's post will be a lighter one.

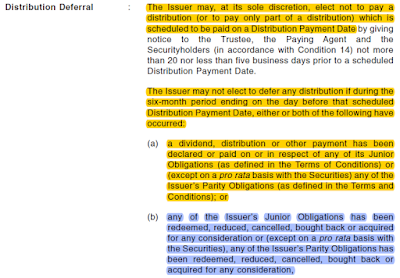

In my post last week, I extracted the relevant portions of the OIS of Hyflux's preference shares and perps to discuss the conditions upon which Hyflux could omit the preference dividend and perps distribution respectively. For me, the most surprising discovery is that the preference shares are ranked pari passu (or have the same seniority) with the perps! See the figure below, which is extracted from the perps' OIS.

|

| Fig. 1: Relative Ranking of Hyflux's Preference Shares and Perps |

All along, I had thought that the preference shares would rank lower than the perps, mainly because the preference shares are a type of shares and perps have characteristics of a bond. Conventional wisdom suggests that a bond must rank higher in seniority than a share. It was only until I read the above from the perps' OIS that I realised that I was wrong!

The relative ranking of the preference shares and perps have important implications for their respective holders. If the preference shares were ranked below the perps, the preference shares would serve as a cushion for the perps. Any losses would be absorbed first by the ordinary shareholders, followed by the preference shareholders before the perp holders suffer a loss. As at Jun 2017, the total debt of Hyflux is $1,308.7M. The equity attributable to ordinary shareholders is about $226.9M (corresponding to net asset value per share of $0.289 for 785.3M shares, which is down from $0.451 in Dec 2016). The debt-to-ordinary-equity ratio works out to be 5.77, which is very high. If the preference shares were ranked below the perps, there is another $392.6M of preference equity between the ordinary equity and the perps. The debt-to-(ordinary + preference)-equity would be 2.11, which is a lot less than the original ratio of 5.77.

Unfortunately, that is not the case. Both preference shares and perps are ranked pari passu with each other. This means that both preference shareholders and perp holders share in the loss together if losses exceed the $226.9M equity attributable to ordinary shareholders.

The key takeaway for me from reading the Hyflux's OIS is never to assume the relative ranking of different instruments based on their names. And if you invest in fixed income instruments, better read the fine print too.

See related blog posts: